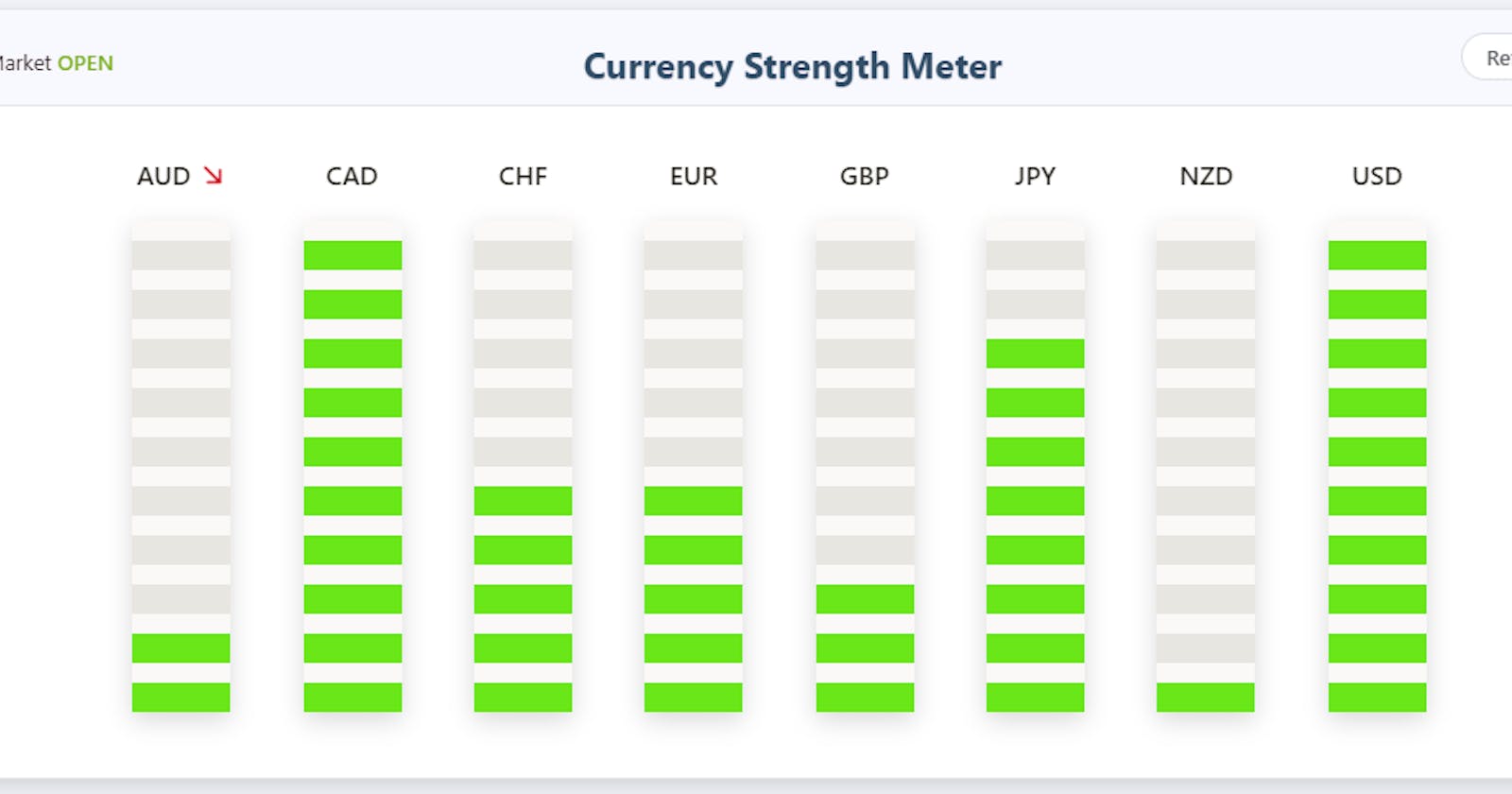

A currency strength meter measures the strength of an asset against others in its category. Currency traders use a currency's CSM to determine whether they want to buy or sell a particular currency.

Currency Strength Meter Definition

A currency strength meter provides investors with the value of a particular currency, representing an accumulation of factors related the currency, like economic news, exchange rate fluctuations, or foreign investor sentiment.

A trader's aim is to use a trading strategy to decide which opportunities are most profitable. It measures the relative strength of currencies against one another.

How to Read a Currency Strength Meter

Technical Currency Analysis (TCA) uses the percentage changes on 148 currency pairs to identify the overall currency strengths for 23 different countries.

- A positive (positive) score indicates a strong currency (a blue bar on the chart).

A positive (positive) score means that a user has liked your post.

- A weak currency (a red bar on the graph) means that its value has declined significantly from its peak.

Live charts update every minute (refreshing your browser may be necessary).

Currency Strength Meters Explained with Examples

Most free foreign-exchange (forex) strength indicators look at the performance of individual currencies against one another. They calculate an average price change for each pair of currencies and divide them to get the overall average.

Better currencies use economic data (fundamentals) related to their own economy to calculate strength. For example, the EURO uses hundreds of economic reports from its own countries to determine its own strength.

Fundamental Analysis is made easier by the fact that it allows its user to easily access the most influential economic indicators, which include the most important ones such as building permits.

A typical currency strength indicator would show the strength or weakness of different countries' currency using the following criteria: Stronger currency means a better long position; weaker currency means a worse short position.

Investors would look for pairs where one has a stronger than average exchange rate against another country’s currencies.

The US dollar is showing a strong positive trend of 36 points and is strengthening against the euro.

Traders would use this as an opportunity to buy the falling US Dollar and sell the rising European currency at once. Short

A better way to determine the true worth of a currency is by using economic reports to discover the real cost of living in that country.

A currency strength meter formula using economic data

When using the economic strength indicator, the currency strength meter considers the different economic sectors, and whether their changes from the previous month are better or worse for the currency.

For each of these 20 variables, we'd get a +1 or - 1 if it was good or bad, respectively, for the economy. One common way to determine which factors are important is through regression analysis.

Investors usually get a total score between – 20 to +20 to determine the strength or weakness of a particular currency. However, some investors use technical analysis tools to speed up their research.

Investors would consider this an increase in the dollar's value and would encourage them to buy dollars.

Currency Strength Meter Pros: It provides an easy way for traders to monitor their

There are different types of currency strength indicators, including forex market strength indicators and macroeconomic indicators. We'll look at their advantages and disadvantages.

A currency strength meter helps you determine whether a particular currency pair is strong or weak against another currency.

- Quickly compares historical currencies' rates of change

- Lagging indicator

- Normally free to use

- No predictive ability

It may look good but it could actually be misleading and lead to poor trading choices.

Currency Strength Meter Tips

Every investment has an objective - to maximise returns for shareholders. However, investors need to consider not just the potential return but also the risks involved. Here are some of our top tips to help you achieve both goals.

- If you don't consider the typical expected movement of prices over the time period you are trading, it is highly likely your stop will close you out too soon! Always, and place a stop off of this calculation.

- If you've been trading Forex successfully, you know that it pays to be aware of the Commitments Of Traders report. It gives you an overview of the current state of the Forex markets.

- Limit your gross exposures:The number one error of investors is over leveraging! Control your exposures to the markets, maintain the borrowing to a minimal, and always preserve your cash. Margin investing has huge potential, but only if it's properly comprehended. Most investors utilize margin to keep on top of this issue. position sizing calculator

We've been trying to decide on the best way to measure and forecast exchange rates for years. Many existing tools were lacking until 2018.

A currency strength meter is an indicator showing whether a particular currency

Currency Strength Meters Can Be Benchmarked Based On Following FACTORS: LogikFX Lead Team

- Predicting the future value of currencies

- The currency options available

- Accessibility

- Cost

- User interface ergonomics

- Customer Support

- Reliability

- Community

- Security

After trying out many different currency exchange rate calculators under those conditions, it wasn't surprising that many of them left a whole bunch to be desired.